How to Trade Carbon Credits

Carbon credits are a way for companies to reduce their carbon emissions. They act like a permission slip that allows the company to claim credit for their efforts. The price of the carbon credits depends on several factors, such as the supply and demand of the market, the underlying project, and the geography of the project.

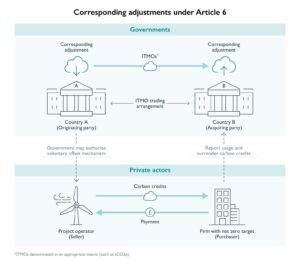

A lot of countries are considering implementing a cap-and-trade program. These programs allow companies to purchase or trade allowances with other companies. This allows companies to cut their pollution faster. They can also sell or bank the excess allowances for use later.

A trade carbon credits system is a way to add market incentives to help companies achieve a net-zero emission goal. Generally, the government sets a cap on the amount of CO2 a company can emit. After a certain amount of time, the cap is reduced. This decreases the incentive for companies to continue burning fossil fuels, so they must find another way to reduce their emissions. It is not always easy for a company to reduce its CO2 output.

How to Trade Carbon Credits in the US

In some jurisdictions, carbon projects can be issued to companies and individuals. These can range from a few cents per metric ton of CO2 emitted to $15 per metric ton for an afforestation project to $300 for a technology-based removal project like CCS. The market for these credits is growing.

Some companies have taken a more active role in reducing their carbon output. Some industries have set net-zero targets, and many other businesses are adopting the same goals. Others are years away from reducing their CO2 emissions substantially. However, the price of carbon credits will likely increase by tenfold in the next decade.

As more industry sectors enter the carbon credit game, more companies will need to find ways to offset their carbon output. This has led to an increase in the number of companies with “net-zero” goals. Increasing consumer pressure to make a difference in the environment has helped drive companies to a voluntary carbon market.

The voluntary carbon market is a type of investment that makes it easier for individuals, companies, and farmers to get into the carbon offset market. It is an opportunity to purchase credits that are accompanied by environmental benefits, such as improved water quality or better air quality.

While there are many reasons to buy carbon credits, a company must make sure the project they choose is legal. To get a project certified, it must meet a number of requirements, such as providing additional social benefits or demonstrating an actual reduction in greenhouse gas emissions.

There are two main markets for carbon credits, the regulatory and the voluntary. The latter is more regulated and can only be used by companies, while the former is more open to individual buyers. In the U.S., the government operates the carbon market. The state of California has its own conglomerate.

There are also a number of financial players that have developed project development and brokering arms. They offer both standardized and non-standardized products. Typically, end buyers want to be able to inspect the underlying project before committing to a purchase. The non-standardized product, however, is more enticing to traders.