Carbon Credit Trading Work

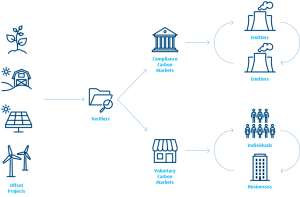

Using carbon credits is a way for companies to offset their carbon emissions. There are two types of markets for carbon credits. These are the voluntary market and the regulatory market. In the voluntary market, carbon offsets are issued by groups that are environmentally conscious. These projects are often localized and involve community-based projects. They typically generate more co-benefits, which means they trade at a higher premium to industrial projects.

The regulatory market is regulated by international organizations. Countries and governmental organizations set limits on greenhouse gas (GHG) emissions and cap the amount of carbon.credit they can emit. Those organizations also regulate the carbon trade. This is done by setting the price of carbon. They also regulate the number of permits and licenses in the market.

The downstream market is comprised of individual consumers and companies. They can buy carbon credits on the open market or finance their own carbon projects. They can also choose to purchase carbon credits from the climate exchange, a spot market that offers a futures and options market for allowances. The carbon prices are normally quoted in Euros per tonne of carbon dioxide. They can be traded internationally. They are sold by brokers. They usually receive a commission.

How Does Carbon Credit Trading Work?

There are also non-standardized products, which allow end buyers to inspect the underlying projects. This protects them from accusations of greenwashing. They can also choose to keep the credits they have issued. The pricing for these products depends on the geography of the project and the time it takes to deliver the carbon.

The standardized carbon credit products are preferred by traders. The standards provide the basic characteristics of the carbon project and certification of its volume and objectives. They are also validated by the UNFCCC. The Verra Carbon Standard is the most widely used standard for certifying carbon projects. This standard includes independent auditing and a registry system. Founded by environmental leaders, the Verra Carbon Standard includes a range of accounting methodologies that are specific to the type of project.

The voluntary market is not mandatory, but it is becoming increasingly popular because more people and organizations are working towards meeting international climate goals. It is a complementary market to the regulatory carbon market. It is designed to make it easier for individuals, businesses and landowners to participate in the offsets market. Unlike the regulatory market, which is mandated, the voluntary market is free to enter.

There are many different kinds of carbon projects. Some of them are industrial projects, which have the potential to produce large volumes of credits. These types of projects can be more easily verified for their GHG offset potential. Typically, they are larger and more expensive to certify. They are more likely to provide co-benefits, such as clean air and water.

If a factory produces more than its quota of greenhouse gases, it must purchase additional carbon credits. If a factory produces less than its quota, it can sell its extra credits to a larger company that has met its quota.