Decentralized OTC

While there are some benefits of decentralized otc crypto trading, there are also some drawbacks to this type of exchange. These exchanges are less user-friendly, don’t usually let you deposit dollars, and may have lower liquidity. To buy or sell crypto on these exchanges, you must have the currency first. Decentralized exchanges also require direct peer-to-peer trading, which is more time-consuming and requires price concessions.

For example, a trader might exchange 10 “A” tokens for ten “B” tokens. To do so, they go through an open pool, where they can exchange the corresponding tokens for a specific amount of “B.” The trader then adds or removes 10 “A” tokens from the pool and keeps the remaining ones. In this way, the ratio no longer remains 1:1, but instead is 1.22 “A” to every “B”. This is not to say that the decentralized exchanges are completely free of regulatory oversight.

Decentralized OTC crypto exchange

The biggest decentralized OTC crypto trading platform, AirCash, was created as a way to address the difficulties of modern-day crypto trading. Unlike most centralized exchanges, AirCash allows users to exchange crypto for fiat wealth without having to go through KYC. Traders keep their funds in backstage wallets, which remain completely decentralized. A decentralized exchange platform puts all of the transaction information on the blockchain, ensuring that the transaction is 100% secure.

Decentralized OTC Crypto Trading

OTC exchanges have become a vital source of cryptocurrency for institutional investors, and the rise of dOTC has made it possible for them to trade high-value digital assets. This technology is not yet fully developed, but it will revolutionize the way businesses conduct business. If the decentralized exchanges catch on, the industry will be in good hands. In the near future, decentralized otc crypto trading could become a reality.

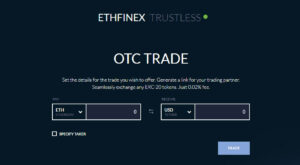

Some of the biggest benefits of decentralized OTC crypto trading are: lower transaction costs and security. Traders can also trade with more confidence on the platform because it eliminates the need for middlemen. Some exchanges have a large volume of ERC-20 tokens. Another advantage is that atomic swaps do not require a middleman. By removing the middleman, the otc market can process $12 billion in transaction volume daily, thereby creating an efficient and secure environment.

One of the first exchanges to offer OTC crypto trading is Goldman Sachs. This brokerage firm has a dedicated institutional coverage team. The company also partners with several large digital currency brokerages such as Satstreet, based in Toronto, Canada. The security of the firm is a primary concern, as it is registered with the Canadian National Financial Transactions Agency FINTRAC. With this experience, OTC crypto trading has the potential to become a viable alternative to the traditional stock exchanges.

Another disadvantage is the lack of transparency. OTC exchanges only offer Bitcoin and a handful of other cryptocurrencies, while conventional exchanges can trade hundreds of digital assets. OTC exchanges are not as transparent as traditional exchanges, and clients may not know their counterparties. As a result, they can be risky. Some OTC exchanges do not have as much regulatory oversight as centralized exchanges. In addition, many investors don’t know if the exchange is regulated and how much liquidity it offers.